SNSF: Programme Overview

- SNF P2P Credit Risk Models. Network-based credit risk models in P2P lending markets

- SNF Narrative Digital Finance Narrative. Narrative Digital Finance: a tale of structural breaks, bubbles & market narratives

- SNF Blockchain Fraud Detection. Anomaly and fraud detection in blockchain networks

- SNF - NSF Explainable AI. Solving the challenges of deploying domain-driven eXplainable AI: Applications in finance

- SERI - Digital Finance. Digital Finance - Reaching New Frontiers

SNSF: The Research Programme

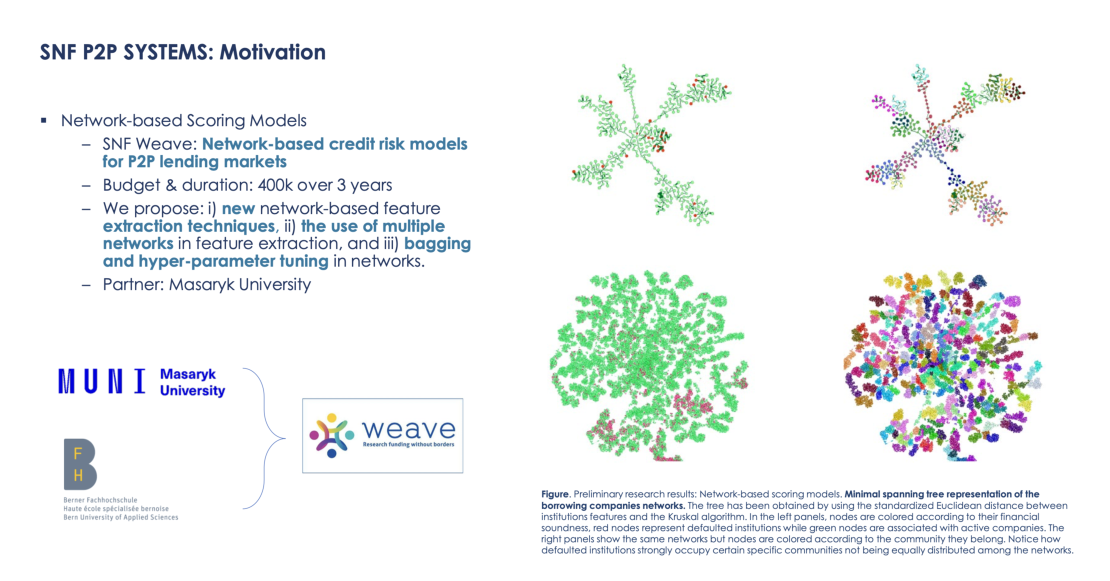

SNSF: Network-based credit risk models in P2P lending markets

P2P (peer-to-peer) lending today consists of the lending of money to individuals and businesses through online services without bank intermediation (Thakor, 2020). P2P platforms offer a secure cyberspace (Niu et al., 2020) where borrowers are linked to investors who engage (usually) in a buyout auction, where the bidding process ends when the loan has been fully funded (Xia et al., 2017). Bank lending is backed by deposits, uninsured debt and equity; thus, banks have skin in the game, unlike P2P lending platforms, where loans are funded by investors directly, i.e., through investors’ equity. Higher interest rates and diversification potential incentivize lenders, represented by individuals and recently also by banks, hedge funds, venture capital firms and private equity firms (Giudici et al. 2019), to participate in P2P lending. Traditional banks receive loan repayments that are used to pay out depositors, subordinated debt holders and potentially shareholders, while P2P platforms receive fees from loan origination (paid by the borrower) and transaction fees. Administration of lending tends to be cheaper for P2P platforms, which provide an online marketplace and initial risk classification, while banks are subject to much tighter regulation and thus have higher costs (Thakor, 2020).

However, banks have much richer data at their disposal (e.g., through long-term relational banking), which makes their task of identifying potential nonperforming loans easier. One would therefore expect P2P platforms to attract borrowers who would otherwise not be eligible for bank loans. This effect is amplified during recessions, as reduced access to bank credit directs riskier borrowers towards the P2P markets. This phenomenon has been observed empirically, as several studies have found that after the 2008 recession, the growth of P2P markets accelerated (e.g., Jin and Zhu, 2015). Similar growth is likely to unfold during and after the current worldwide economic crisis induced by the COVID-19 pandemic. Given the nature of P2P markets, they are characterized as immature industries with loose regulation, greater information asymmetry and increased credit risk, which all lead to higher default rates. This leaves the door open to considerable risks.

To mitigate adverse selection and moral hazard problems, one needs to build trust. In traditional bank-lending markets, trust is constructed via relational banking, using collateral, certified accounts, risk monitoring, the presence of a board of directors, tighter regulation, etc. (Emekter, 2015). Voluntary implementation of these mechanisms would incur significant costs and thus marginalize the competitive edge of P2P lending markets. Several recent studies have found that the failure of P2P platforms in China is related to general market conditions (bond yields), ownership, information disclosure, and popularity, while political ties were found to also play an important role (e.g., Gao et al., 2021, He and Li, 2021). A hands-on approach to establishing trust between investors and P2P markets is to use accurate credit risk models. The main objective of the proposed research project is to design a state-of-the art and interpretable credit risk models for P2P lending markets.

Sources:

- Emekter, R., Tu, Y., Jirasakuldech, B., & Lu, M. (2015). Evaluating credit risk and loan performance inonline Peer-to-Peer (P2P) lending. Applied Economics, 47(1), 54-70.

- Gao, M., Yen, J., & Liu, M. (2021). Determinants of defaults on P2P lending platforms in China. International Review of Economics & Finance, 72, 334-348.

- Giudici, P., Hadji-Misheva, B., & Spelta, A. (2019). Network based scoring models to improve credit risk management in peer to peer lending platforms. Frontiers in Artificial Intelligence, 2, 3.

- He, Q., & Li, X. (2021). The failure of Chinese peer-to-peer lending platforms: Finance and politics. Journal of Corporate Finance, 66, 101852.

- Jin, Y., & Zhu, Y. (2015, April). A data-driven approach to predict default risk of loan for online peer-to-peer (P2P) lending. In 2015 Fifth International Conference on Communication Systems and Network Technologies (pp. 609-613). IEEE.

- Niu, K., Zhang, Z., Liu, Y., & Li, R. (2020). Resampling ensemble model based on data distribution forimbalanced credit risk evaluation in P2P lending. Information Sciences, 536, 120-134.

- Thakor, A. V. (2020). Fintech and banking: What do we know? Journal of Financial Intermediation, 41, 100833.

- Xia, Y., Liu, C., & Liu, N. (2017). Cost-sensitive boosted tree for loan evaluation in peer-to-peer lending. Electronic Commerce Research and Applications, 24, 30-49.

Publications

Liu, Y., Baals, L. J., Osterrieder, J., & Hadji-Misheva, B. (2024). Leveraging network topology for credit risk assessment in P2P lending: A comparative study under the lens of machine learning. Expert Systems with Applications, 252, 124100.

Liu, Y., Baals, L. J., Osterrieder, J., & Hadji-Misheva, B. (2024). Network centrality and credit risk: A comprehensive analysis of peer-to-peer lending dynamics. Finance Research Letters, 63, 105308.

Conferences

- Presentation at the 8th European COST Conference on Artificial Intelligence in Finance, Sep 29, 2023, Bern, Switzerland.

- Presentation at the 16th International Conference of the ERCIM WG on Computational and Methodological Statistics and the 17th International Conference on Computational and Financial Econometrics, Dec 16 - 18, 2023, Berlin, Germany.

- Presentation at the COST FinAI Meets Istanbul Conference on Fintech and Artificial Intelligence in Finance at Yıldız Technical University, May 20 - 21, 2024, Istanbul, Turkiye.

- Presentation at the COST Action FinAI: Fintech and AI in Finance - Training School at the University of Twente, Jun 10 - 14, 2024, Enschede, the Netherlands.

Third-Party Funding Aquisitions

- Funding application and project participation for Leading House Asia: 2023 Call for Applied Research Partnership Grants. Team member: Yiting Liu, Joerg Osterrieder, Branka Hadji-Misheva, Lennart John Baals, Jeffrey Chu, Stephen Chan. Budget: 50, 000 CHF.

Our Team